Top 5 Best Decentralized Exchanges To Watch In 2024: Revolutionizing Decentralized Trading

An Introduction To Best Decentralized Exchanges In 2024

The era of exclusive centralized cryptocurrency trading platforms has given way to a growing trend in decentralized exchanges (DEX). According to recent data, the rise of decentralized exchanges (DEX) is reshaping the cryptocurrency trading landscape at a rapid pace. In the last year alone, DEX trading volumes increased by over 150%, with a total trading volume surpassing $1.5 trillion.

This surge in DEX adoption is further underscored by the fact that more than 50% of all decentralized exchanges now operate through smart contracts, enhancing transparency and security for both cryptocurrency enterprises and investors.

So are you interested in buying, selling, and trading cryptocurrency through a decentralized exchange?

Our team of experienced professionals has conducted an extensive market analysis to identify the finest decentralized exchanges tailored to your needs. By the end of this blog, you will gain insight into the top 5 best decentralized exchanges and their diverse range of features.

What Is A DEX Cryptocurrency Exchange?

A DEX, or Decentralized Exchange, is a type of cryptocurrency exchange that operates without the need for an intermediary or centralized authority. It allows users to trade cryptocurrencies directly with one another, typically through smart contracts on blockchain networks.

The best decentralized exchanges offer increased security and transparency as they don’t hold users’ funds, reducing the risk of hacks. They enable users to maintain control of their private keys and assets, promoting self-custody.

Decentralized exchanges have effectively superseded conventional trading practices. They’ve substituted traditional order books with liquidity pools, while Automated Market Makers (AMMs) play a pivotal role in connecting cryptocurrency buyers and sellers, using trading volume as a guiding principle.

The adoption of DEX platforms has resulted in improved token price optimization, reduced swap fees, minimized slippage, and enhanced accessibility to cryptocurrency trading.

Note: It’s important to emphasize that DEXs facilitate peer-to-peer crypto transfers and trading, but they do not support the exchange of cryptocurrencies for traditional fiat currencies such as the US Dollar, Indian Rupee, Euro, and others.

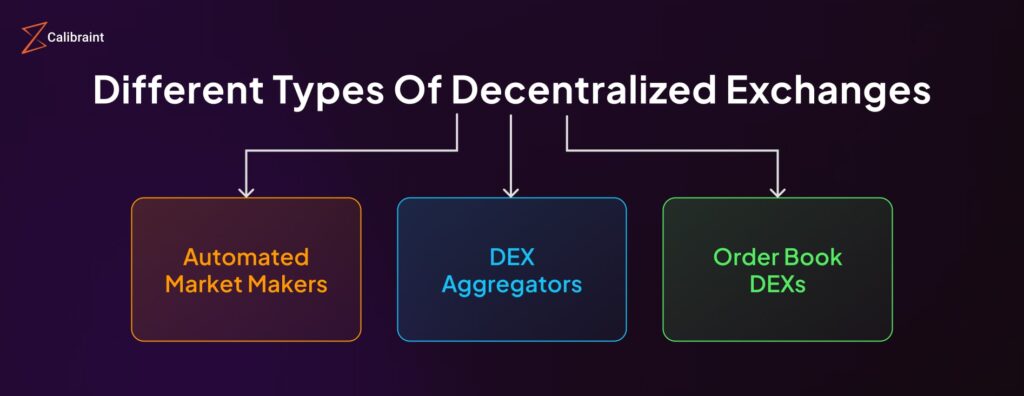

Different Types Of Decentralized Exchanges

There are different types of DEX, each with its own unique features and use cases, catering to the diverse needs of cryptocurrency traders and investors. Three main types of Decentralized Exchanges are:

Automated Market Makers (AMMs): These DEXs use smart contracts to create liquidity pools where users can trade cryptocurrencies without the need for traditional order books. AMMs, like Uniswap, determine prices based on a constant mathematical formula, enabling users to swap assets efficiently.

DEX Aggregators: DEX aggregators employ various protocols and strategies to enhance the liquidity of cryptocurrency exchanges. These platforms consolidate liquidity from multiple blockchain networks, reducing slippage fees and offering traders optimal token swaps at competitive prices, ultimately boosting their profitability.

The best DEX aggregators effectively address the challenge of matching SWAP orders across multiple decentralized exchanges, improving traders’ profit potential while mitigating the impact of price volatility. These platforms empower traders with enhanced profit opportunities and act as a safeguard against price discrepancies.

Order Book DEXs: Similar to centralized exchanges, these DEXs rely on order books to match buyers and sellers at specific prices. They offer greater control and precision in trading but may have lower liquidity compared to AMMs. Examples include DEXs like 0x.

Now that we have looked into the types of Decentralized Exchanges, let us now look into the 5 best decentralized exchanges that you have to look for in 2024.

Top Best Decentralized Exchanges For 2024

Here is a list of decentralized exchanges that you can look out for in 2024:

1. Uniswap

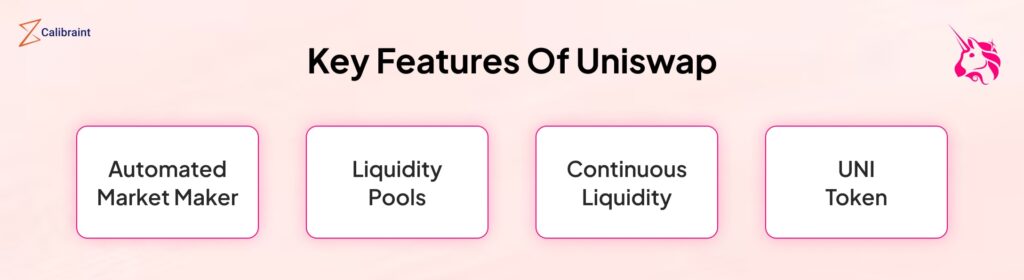

Uniswap exchange, one of the pioneers in the DEX space, is an automated market maker (AMM) protocol built on the Ethereum blockchain. It allows users to swap various ERC-20 tokens without the need for an intermediary. Uniswap exchange utilizes liquidity pools instead of order books, ensuring continuous liquidity and minimal slippage for traders. The UNI token is a significant component of the Uniswap ecosystem, enabling governance and providing a share of transaction fees to liquidity providers.

Key Features Of Uniswap:

The key features of Uniswap include:

Automated Market Maker (AMM): Uniswap operates on the AMM model, enabling trades based on predefined smart contract algorithms rather than traditional order books. This design enhances accessibility and liquidity by allowing users to trade directly from their wallets without the need for a counterparty.

Liquidity Pools: Uniswap employs liquidity pools, where users can deposit their tokens to provide liquidity for specific trading pairs. These pools form the basis for the exchange, ensuring a continuous and decentralized liquidity supply.

Continuous Liquidity & Minimal Slippage: The utilization of liquidity pools ensures that there is always liquidity available for trades. This reduces slippage, providing a more predictable trading experience for users even when dealing with larger transactions.

UNI Token: The UNI token is a fundamental component of the Uniswap ecosystem. It holds dual significance by enabling governance participation, allowing the community to have a say in the platform’s development, and providing a share of transaction fees to liquidity providers, incentivizing active participation.

Uniswap’s impact on the DeFi landscape is substantial. Its innovative approach to decentralized trading has paved the way for countless other DEXs and DeFi applications, transforming the way users interact with cryptocurrencies and inspiring further advancements in the blockchain space.

2. SushiSwap

Forked from Uniswap, SushiSwap is a community-driven DEX that has rapidly gained popularity. It enhances Uniswap’s features and introduces its native token, SUSHI. SushiSwap incentivizes liquidity providers with SUSHI tokens and offers more control to the community through its decentralized governance model. The project has become a prominent player in the DeFi landscape, promoting decentralization and sustainability.

Key Features Of SushiSwap:

The key features of SushiSwap include:

Community-Driven Model: One of the fundamental pillars of SushiSwap is its community-driven approach. Participants are encouraged to actively engage in the decision-making processes of the platform, fostering a sense of ownership and decentralization. This model empowers users to propose and vote on changes, upgrades, and protocols, ensuring that the platform evolves in a direction that aligns with the collective vision.

SUSHI Token: The introduction of the SUSHI token incentivizes and rewards liquidity providers within the SushiSwap ecosystem. Liquidity providers receive a share of the platform’s fees in proportion to the amount of liquidity they provide. Holding SUSHI tokens also grants users voting rights in the platform’s governance, enabling them to influence its future trajectory.

Enhanced Features: SushiSwap incorporates several enhancements over its predecessor, Uniswap. These enhancements include increased rewards for liquidity providers, reduced fees, and improved capital efficiency through features like ‘Onsen’ and ‘Kashi.’ These improvements were designed to attract users and liquidity while promoting a sustainable and thriving DeFi ecosystem.

Migration and AMM: SushiSwap initiated with a migration feature, allows users to move their liquidity and LP tokens seamlessly from Uniswap to SushiSwap. Additionally, it utilizes an Automated Market Maker (AMM) model, akin to Uniswap, ensuring smooth and efficient trading by utilizing liquidity pools.

SushiSwap’s rapid rise in popularity underscores the importance of community governance and incentives within the DeFi space. By building upon Uniswap’s success and enhancing its features, SushiSwap has not only provided users with an improved DEX experience but has also showcased the potential for community-driven initiatives to shape the DeFi landscape.

3. PancakeSwap

PancakeSwap exchange is a DEX built on Binance Smart Chain (BSC), designed to offer a faster and more cost-effective alternative to Ethereum-based DEXs. It replicates the functionalities of Uniswap but with lower transaction fees and faster confirmation times. The CAKE token, PancakeSwap‘s native utility token, is used for governance, staking, and earning a share of the platform’s fees.

Key Features Of PancakeSwap Exchange:

The key features of PancakeSwap include:

Binance Smart Chain (BSC) Integration: PancakeSwap’s integration with Binance Smart Chain is central to its success. By leveraging BSC, the platform ensures rapid transaction confirmations and significantly reduced fees compared to Ethereum-based DEXs. This integration opened up new horizons for users, enabling efficient trading and facilitating a broader user base.

CAKE Token: The native utility token of PancakeSwap, CAKE, plays a pivotal role within the ecosystem. CAKE holders enjoy governance rights, allowing them to propose and vote on changes, thus influencing the platform’s development. Additionally, CAKE holders can stake their tokens to earn rewards and a share of the platform’s trading fees, encouraging active participation and engagement.

Familiar AMM Model: PancakeSwap adopts an Automated Market Maker (AMM) model similar to Uniswap, ensuring continuous liquidity through liquidity pools. Users can effortlessly swap various BEP-20 tokens, and liquidity providers can earn a portion of the trading fees proportional to their stake in the liquidity pool.

Farms and Syrup Pools: PancakeSwap introduces ‘Farms’ and ‘Syrup Pools’ to incentivize users to provide liquidity and stake their CAKE tokens. Users can earn CAKE rewards by participating in these pools, promoting a vibrant and engaged community.

PancakeSwap’s success as a leading and best decentralized crypto exchange on Binance Smart Chain epitomizes the importance of scalability and cost-effectiveness in the DeFi space. By replicating the proven AMM model and enhancing it with lower fees and faster transactions, PancakeSwap has successfully attracted a significant user base and established itself as a fundamental player in the evolving DeFi landscape.

4. Balancer

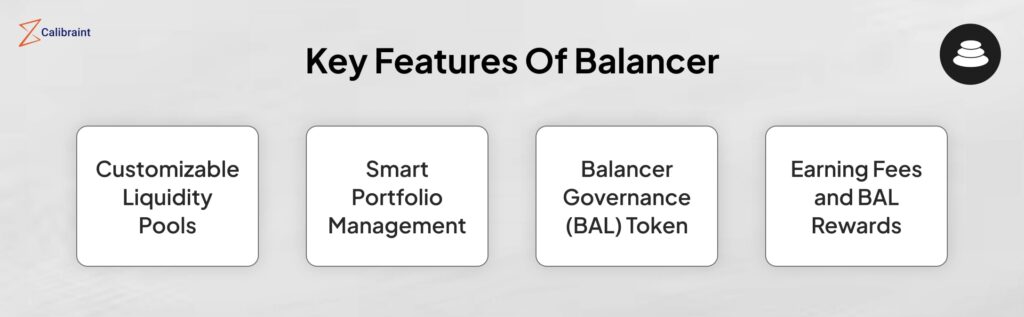

The Balancer is a unique and best decentralized crypto exchange protocol that allows users to create liquidity pools with multiple tokens and different weights. This provides flexibility and enables customized asset allocation within the pool. Balancer’s smart portfolio management attracts users seeking dynamic exposure to various assets. The BAL token governs the Balancer protocol and offers rewards to liquidity providers.

Key Features Of Balancer:

The key features of Balancer include:

Customizable Liquidity Pools: Balancer allows users to design liquidity pools comprising multiple tokens with different weightings. For instance, a liquidity pool can contain four tokens with weights of 40%, 30%, 20%, and 10% respectively, offering a high degree of customization. This customization feature attracts a diverse user base, including DeFi enthusiasts and sophisticated investors seeking tailored portfolio exposure.

Smart Portfolio Management: The ability to set custom weights enables smart portfolio management within a single Balancer pool. Users can rebalance their portfolios automatically based on market conditions, maintaining their desired asset allocation. This dynamic aspect appeals to investors looking for more control and agility in managing their assets within the DeFi space.

Balancer Governance (BAL) Token: The governance and economic model of Balancer is underpinned by the BAL token. BAL holders can participate in platform governance by proposing and voting on changes to the protocol. Moreover, liquidity providers are incentivized with BAL tokens, encouraging active engagement and contribution to the network’s liquidity.

Earning Fees and BAL Rewards: Liquidity providers earn fees from trades within the liquidity pool, distributed based on the pool’s weights. Additionally, they receive BAL tokens, enhancing their overall rewards. This dual incentive mechanism encourages users to both provide liquidity and actively participate in the governance of the Balancer protocol.

Balancer’s pioneering approach to liquidity provision introduces a level of flexibility and customization previously unseen in DeFi. By enabling users to create pools with multiple tokens and varied weights, Balancer revolutionizes portfolio management in the decentralized finance landscape. This innovative concept attracts both casual and professional investors, showcasing the platform’s versatility and potential to shape the future of DeFi.

5. 1inch

1inch is not a DEX itself but an aggregator that finds the best available swap rates across various DEXs. It routes trades through different protocols to optimize outcomes for users. By splitting trades across multiple DEXs, 1inch minimizes slippage and ensures efficient asset swaps. The native 1INCH token offers governance rights and fee discounts.

Key Features Of 1inch Exchange:

The key features of 1inch exchange include:

Aggregated Liquidity: 1inch integrates with several decentralized exchanges and aggregates their liquidity. When a user initiates a trade, 1inch searches for the best available rates across these platforms. By splitting the trade into multiple parts and executing them through various DEXs, the aggregator minimizes slippage, resulting in more cost-effective trades for users.

Intelligent Routing: The platform employs a sophisticated routing algorithm to determine the optimal path for each trade. It considers factors such as liquidity, trading fees, and the price impact of the trade to ensure users get the best possible rates. This intelligence in routing is a key feature that sets 1inch apart from other platforms.

1INCH Governance Token: The native governance token of 1inch, 1INCH, plays a crucial role in the platform’s ecosystem. Token holders can participate in governance proposals, suggesting and voting on changes to the protocol. Additionally, 1INCH holders are eligible for fee discounts on trades within the 1inch ecosystem, enhancing their overall trading experience and incentivizing token ownership.

Enhanced User Experience: 1inch is designed with a user-centric approach, aiming to simplify the trading process for both newcomers and experienced DeFi users. The intuitive interface and efficient trading mechanisms make it easy for users to access the benefits of multiple DEXs seamlessly, consolidating the best features of each into a unified platform.

1inch’s innovative approach to DEX aggregation addresses the challenges of liquidity fragmentation in the DeFi space. By providing an efficient and cost-effective way to trade assets across various DEXs, 1inch empowers users to optimize their trades and make informed decisions. The 1INCH governance token further engages the community, ensuring a decentralized and collaborative evolution of the platform.

Comparative Analysis

Each of these top decentralized exchanges has its unique features, advantages, and communities. Uniswap stands as the pioneering force in AMM-based DEXs, while SushiSwap and PancakeSwap bring innovation and community governance. Balancer offers versatility in liquidity provision, and 1inch ensures users get the best rates across platforms.

Future Outlook

The world of top decentralized exchanges is evolving rapidly. As DeFi continues to grow, these protocols for decentralized exchanges are likely to incorporate layer 2 solutions, improve scalability, and enhance user experiences. Cross-chain compatibility and integration with traditional finance will likely play a significant role in the future of DEXs.

Closing Lines

Decentralized exchanges and decentralized exchange development are reshaping the way we trade cryptocurrencies, emphasizing community governance, user empowerment, and efficient asset swaps. The top 5 best decentralized exchanges discussed here represent the forefront of innovation, setting the stage for a decentralized and user-centric financial ecosystem.

Stay tuned for more updates on the evolving landscape of DEX protocols and their impact on the broader DeFi space. Happy trading!

Frequently Asked Questions On DEX Protocols

1. What Are The Top 5 DEX Protocols For 2024?

The top 5 DEX protocols for 2024 include Uniswap, SushiSwap, PancakeSwap, 1inch, and Balancer.

2. How Do DEX Protocols Differ From Traditional Centralized Exchanges (CEX)?

DEX protocols operate without a central authority, utilizing smart contracts on blockchain networks for trading. They offer more control and privacy to users. In contrast, centralized exchanges are operated by a company, holding users’ funds and requiring trust in the platform.

3. Are DEX Protocols Safe For Trading In 2024?

DEX protocols can be secure, but users need to exercise caution. Make sure you’re using reputable platforms, verify the smart contracts, and be aware of potential risks like impermanent loss.